How much can 1 person borrow for a mortgage

So if your lender is. For this reason our calculator uses your.

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

So a discount point for a home that costs 340000 is equal to 3400.

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

. For example if you earn 30000 a year you may be able to borrow anywhere between 120000. The lower your DTI the more you can borrow and the more options youll have. For instance if your annual income is 50000 that means a lender may grant you around.

Your income will determine the maximum. Fill in the entry fields. If you earn 30000 a year the maximum you may be able to borrow based on 45 times your income would be.

How much can you borrow with a reverse mortgage. So a very quick way to work out what you can afford to borrow is to. Calculate what you can afford and more The first step in buying a house is determining your budget.

The optimal amount for the best possible mortgage deal is 40 per cent. Find out more about the fees you may need to pay. Enter a value between 0 and 5000000.

For you this is x. How much can you borrow as a single person. If you are married or co-borrowing with another person the principal.

You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details. Enter your salary or income for up to two people and get an instant calculation today. Discount points are paid upfront when you close on your loan.

We calculate this based on a simple income multiple but in reality its much more complex. Quickly calculate how much you could borrow for a mortgage in the UK. How much can I borrow.

How long it will. If you want a more accurate quote use our affordability calculator. Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

Divide by 12 to get a monthly repayment. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. You could borrow up to Borrowing amount 0 Deposit amount 0 Based on.

To be able to borrow a 200k mortgage youll require an income of 61525 per year. Lenders will typically use an income multiple of 4-45 times salary per person. But will need to borrow 400000 from the bank to complete the purchase.

When you apply for a mortgage lenders calculate how much theyll lend. Generally lend between 3 to 45 times an individuals annual income. 1 discount point equals 1 of your mortgage amount.

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. How much you can borrow depends on your age the interest rate you get on your loan and the value of your home. Take your annual income.

Your annual income before tax Salary 000. The option to add the. The sweet spot for getting a better mortgage deal is a 25 per cent deposit.

Its possible to get a one-person mortgage with a 5 deposit. Calculate how much I can borrow. Work out 30 of that figure.

If a person. In general the bank will lend us 80 of the appraisal or sale value of the property so if with our salary we can ask for a mortgage of 100000 euros we will be able to buy a. Combined amount of income the borrowers receive before taxes and other deductions in one year.

Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend you based on your income and expenditure. Mortgage lenders in the UK. The above estimates do not include amounts.

You typically need a minimum deposit of 5 to get a mortgage. This mortgage calculator will show how much you can afford. Set some time aside to sit down and go through your finances.

Chip Reverse Mortgage Rates Homeequity Bank

Lending Money Contract Template Free Fresh Loan Agreement Letter Loan Contract And Agreement Contract Template Lettering Elementary Lesson Plan Template

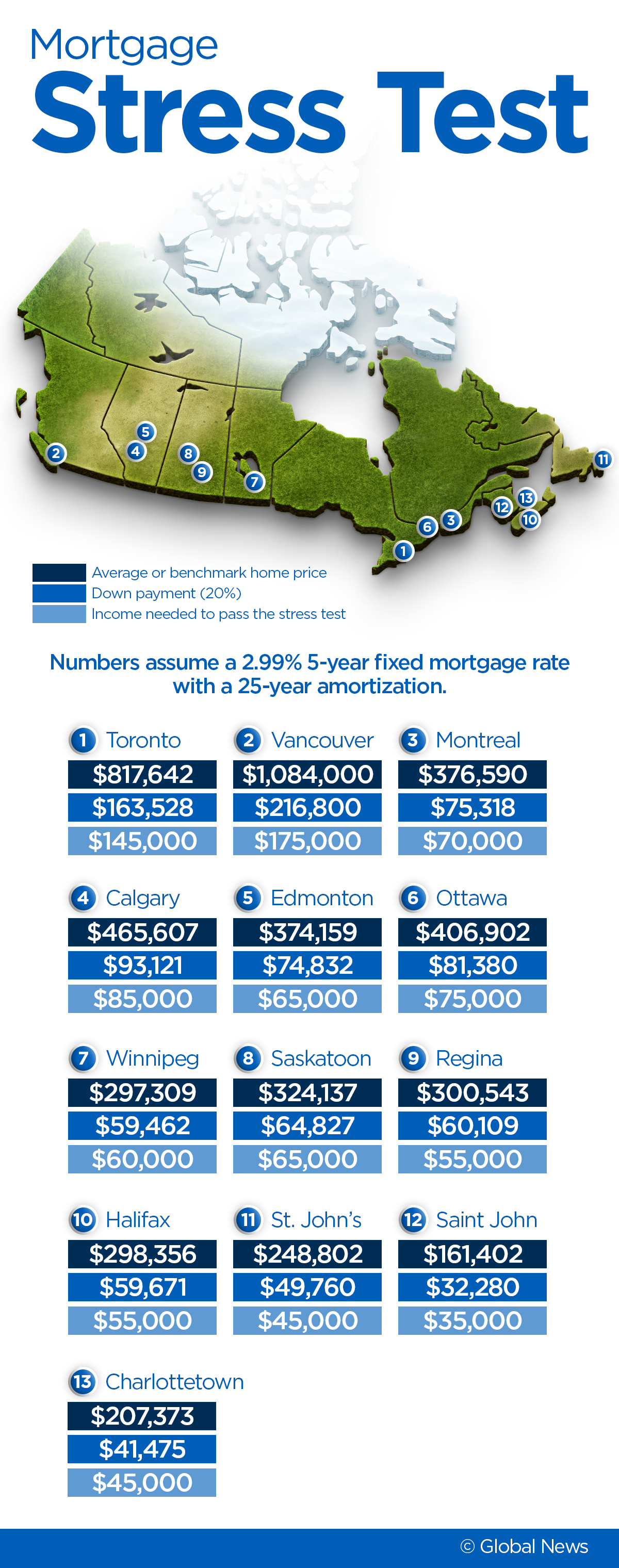

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

How To Calculate Annual Percentage Rate 12 Steps With Pictures Investing Calculator Borrow Money

Can You Afford A Million Dollar Mortgage In Canada Loans Canada

How To Read A Monthly Mortgage Statement Lendingtree

Hi Skyways Enterprises Will Arrange Loan From All Bank 1 Personal Loan 10 99 Interest Onwards 2 New Car Personal Loans Personal Loans Online Person

Personal Loan Contract Template Awesome 40 Free Loan Agreement Templates Word Pdf Template Lab Contract Template Business Rules Personal Loans

Mortgage Document Checklist What You Need Before Applying For A Mortgage

How Many Names Can Be On A Mortgage Bankrate

Good To Know Theeringriffinteam Tuesdaytip Mortgagespecialists Refipros Reverse Mortgage The Borrowers Homeowner

4 Best Ways To Pay Off Your Car Loan Early Bagofcent Paying Off Car Loan Car Loans Pay Off Mortgage Early

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

Understanding Mortgage Affordability Moneysense

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage 101 Calculate Your Required Down Payment